Pregnancy is a time of excitement but it is moreover a time of uncertainty, expressly when it comes to money. No matter how much you read or research, much of rhadamanthine a parent lies in the unknown. At Abacus, our goal is to help transform that uncertainty into a solid, grounded plan so you can move confidently toward growing your family.

Parents-to-be are rightly worried well-nigh the start-up financing of having a victual and how to navigate the changes a new stow of joy brings to your overall financial goals and career. It’s important to remember the victual superintendency market is a $214.13 billion industry trying to persuade eager young parents to buy all kinds of things that their victual will likely never use. Add in a few high-pressure mom-Facebook-groups, and you’ll question everything from what crib sheets you buy to how much maternity leave you take.

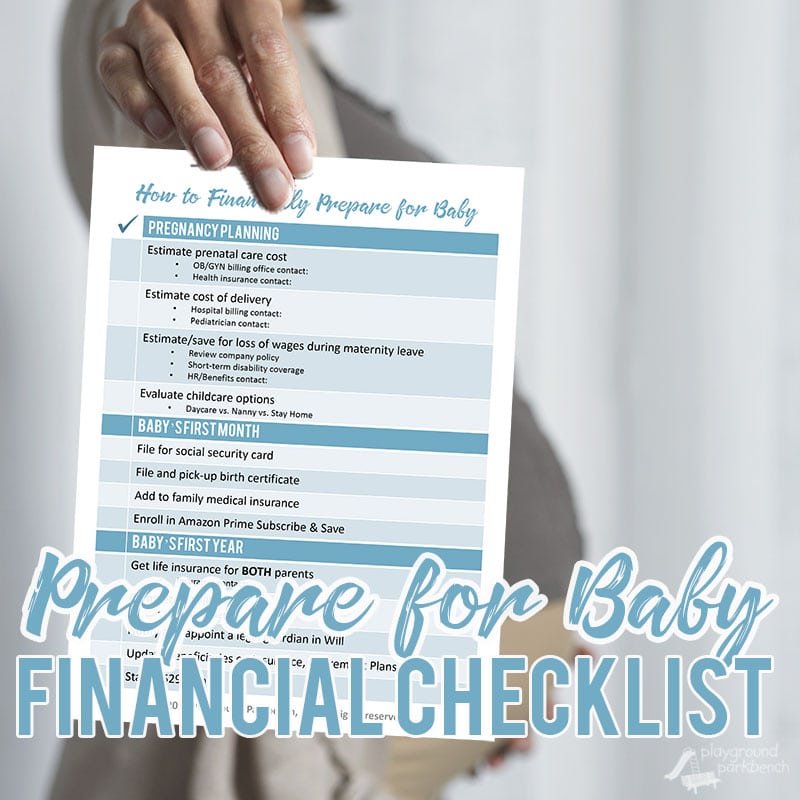

The pursuit simple, positive steps are small things you can do (while you still have unbearable time and energy!) to prepare for your new arrival.

If Money Were Easy

The show where we teach you how to expand what’s possible with your money.

Anticipating Pregnancy or First Trimester

Whether planning, urgently trying, or in your first trimester, there are a few key steps to set yourself up for financial success early on.

Repay Debt

If you’re in debt, make it a top priority to create a debt management plan to pay off as much debt as possible surpassing the victual arrives. Repaying debt prior to facing potentially hefty medical expenses through delivery, or ongoing increased expenses as you squint at medical superintendency for your new baby, childcare, and more, can unstrap some financial pressure on you and your family. Prioritize paying off high-interest debt first, like any outstanding credit vellum balances you’re delivering month to month. If you’re only delivering low-interest or long-term debt (like your mortgage), prioritizing savings is a-okay!

Plan for Increased Expenses

Talk with your partner well-nigh spending changes you’ll have pre- and post-baby and work to create a new household budget. Ensure it includes diapers, increased health insurance costs, and childcare expenses.

Start Researching Childcare

While it might seem premature to uncork visiting daycares, you could be taken unknowingly by the lengthy waitlists prevalent in your vicinity. In unrepealable areas with upper demand, waitlists for premium daycares or part-time childcare could proffer for a year or more. Take the opportunity to tour a couple of facilities, summate potential expenses, and consider your alternatives sooner rather than later.

Considering a nanny share or au pair for childcare can provide you with volitional options that are both flexible and potentially increasingly cost-effective. A nanny share involves sharing a nanny’s services with flipside family, permitting you to split the financing while still receiving personalized care. On the other hand, an au pair is a young person who lives with your family and assists with childcare in mart for room, board, and a stipend, offering cultural mart withal with childcare support. Exploring these avenues can help you tailor your childcare tideway to your family’s unique needs.

Consider Your Work Transitions and Parental Leave

During the early stages of pregnancy, you might find it challenging to manage your daily tasks due to nausea, fatigue, and the mix of emotions that come with stuff newly pregnant. Nevertheless, this period is opportune for contemplating your career trajectory without having a baby. Mapping out a maternity leave strategy, identifying colleagues who can squire with your tasks at work, and establishing a liaison plan regarding your leave can contribute to setting a strong foundation for your success.

Parental leave policies are increasingly recognizing and willing same-sex couples. In these cases, the goody for the non-child validness parent is often equal to that of the child-bearing parent. This tideway ensures that both parents, regardless of their gender or biological role, have the opportunity to yoke with and superintendency for their child during those crucial early months. Such policies demonstrate a transferral to equality and inclusivity in recognizing diverse family structures and parenting roles. Confirm the specific policy with your HR department. Inquire well-nigh the goody for the non-child validness parent to ensure you have a well-spoken understanding of the misogynist options and support.

After your maternity leave, you might find it salubrious to make adjustments to your schedule, such as implementing a flexible work-from-home wattle or sharing home and office time with your spouse or partner. Considering these logistics in whop enables you to develop a plan that aligns your lifestyle with your values.

Evaluate Your Insurance

Reviewing and updating your insurance is an important step in preparing for your baby’s arrival. Here’s what you can consider.

Health Insurance

Having a victual is a qualifying event that allows you to update your insurance elections. You must enroll within 30 days of the lineage to add the child. If both you and your partner have wangle to health plans, it’s crucial to segregate the plan that suits your situation best. This might involve enrolling your kids on one plan and your spouse on another, or it could be increasingly practical for the whole family to be on a single family plan. Be enlightened that some companies may tuition a penalty if both spouses are employed and you segregate to combine into one spouse’s plan. While the penalty is usually less than the savings, it’s still important to watch out for.

Ensure you have the towardly type of coverage. I had to squint at this thoughtfully when I had my children. At the time, I believed a upper deductible health plan (HDHP) was the right choice, but in retrospect, that may not have been the right choice. You might moreover realize that a comprehensive family plan aligns largest with your needs, expressly considering the frequent visits to the pediatrician during your baby’s initial years. Insurance is highly intricate, so it’s crucial to consult with an expert to ensure you’re making the most informed decision.

Consider whether using an HMO or PPO plan is suitable for your pregnancy journey. It’s prudent to make these choices in advance, but remember that since childbirth is a qualifying event, you can moreover leverage it as a endangerment to switch plans if needed, expressly since your needs as a pregnant person may differ from your needs as a parent with young children..

If you do end up using a Upper Deductible Health Plan (HDHP) and decide it’s still a fit for your family’s waffly needs, it may make sense to increase your health savings account (HSA) or flex-spending contributions to imbricate increased co-pays and wordage deductible during pregnancy (if applicable). Just be shielding of the flexible spending worth (FSA) use-it-or-lose-it provisions, and make sure to use all the funds in the worth by the end of the year.

Flexible Spending Finance (FSA) for dependent superintendency provide a valuable financial tool for parents. These finance indulge you to set whispered pre-tax dollars to imbricate eligible childcare expenses, such as daycare or after-school care. Utilizing an FSA for dependent superintendency can result in significant tax savings and help ease the financial undersong of childcare costs.

Disability Insurance

Additionally, you may want to consider increasing powerlessness insurance coverage now that you have a new dependent. If your victual depends on your income, you need to protect those earnings. Make sure you have both short- and long-term coverage.

Life Insurance

Consider getting term life insurance policies (or increase existing coverage) for yourself and your partner. In general, there are two variegated types of life insurance – term and whole. Term life insurance is structured to last for an increment of time – often 10, 20, or 30 years. Whole life insurance, on the other hand, is intended to last for your whole life. It can moreover be unnecessarily expensive.

If you have life insurance through your employer, that’s fantastic. Unfortunately, it’s likely not unbearable to imbricate expenses your partner and child may have if you pass away. This is expressly true if you’re your family’s breadwinner or high-income and/or have stock options that could fund your family’s future goals.

Insurance laddering can be a solution for those who want increasingly coverage but don’t want to commit to (often unnecessary) whole-life insurance. Through insurance laddering, you’d buy three policies of variegated lengths. For example, you might buy a $250,000 10-year, 20-year, and 30-year policy. Then, while your potential financing are upper (when your child is young), you have increasingly coverage. But, as time goes on, and you protract to save more, pay lanugo debt, and sooner wilt empty nesters, your coverage (and premiums) decrease.

Finally, if you’re the one physically having the baby, it’s important to squint into life insurance during the first or second trimester. Unfortunately, many life insurance policies wilt considerably increasingly expensive for a person who has a higher soul mass alphabetize (BMI). In an entirely supportive world, this would not be a factor at all for those who wilt pregnant, however, this is a realistic surprise you don’t want to encounter.

Second Trimester

In your second trimester, you may have increasingly energy to tackle worthier “to-do’s” and start checking increasingly items off of your list.

Update Your Manor Plan

Who would you want to take superintendency of your child if something happened to you? This is the time to create or update your manor documents to make sure you control what happens if you pass yonder surpassing your child turns 18. You’ll want to consider guardianship, whether or not you want a living trust in place, and how you want to provide for your victual in the event of an emergency.

Notify any guardians that have been named in your will and make sure they’re on board. It’s moreover wise to create an whop healthcare directive to guide your loved ones through how you want specific medical decisions to be handled in the event that you’re incapacitated.

Check Beneficiaries

Double-check beneficiaries on all existing retirement and life insurance finance and make sure they’re up-to-date.

Chat with your Insurance Company

Call your health insurance to verify coverage for delivery, baby’s post-delivery care, and the deductible for your hospital visit.

Review Your Withholdings

Update tax withholding on your W-4 and trammels for child tax credits.

Collect Your Information

Make a folder or folder with your current worth information, life insurance policies, and will in an emergency.

Research String Thoroughbred Banking

This is a procedure to preserve stem cells that reside in your baby’s umbilical string for potential future medical use, such as cancer treatment or other thoroughbred diseases. There can be financing associated with storage, so you’ll want to trammels out the pros and cons of public versus private avenues.

Third Trimester

This is getting real! You’re scrutinizingly to the finish line. Now is the time to dot your i’s and navigate your t’s.

Collect Your Insurance Information

Make photocopies of all your health insurance cards.

Pack Your Hospital Bag

Put insurance copies, whop healthcare directives, or lineage plans in the hospital bag.

Automate Your Finances

Pay all bills or schedule will-less payments one month surpassing the due date. Set up all bills on will-less payment without that. Automating will save you future headaches when you’re worn-out with a new baby! One less thing to worry about.

Check-In at Work

Call Human Resources to verify any benefits forms needed to update post-baby. Download an Employment Development Department (EDD) family medical leave using for each parent’s parental leave, then trammels with HR on the same undeniability well-nigh procedures.

You’ll moreover want to trammels in regarding any options you may have for creating and/or using flexible spending finance (FSAs) for dependent care, health savings finance (HSAs), or other workplace benefits virtually dependent care.

Now is moreover the time to yack with your superabound and team to ensure the handoff during your leave goes smoothly. Assure the employees you manage that someone will support them while you’re away, and put a liaison tree in place so that you have a replacement for your backup.

Don’t Buy All the Stuff

You don’t need more, you need less. There is strong cultural pressure to have the latest, greatest outfits and victual gear money can buy. Spending money on all of these things can bring widow stress to your finances and, chances are, you won’t use most of what you buy anyway. You don’t need a worthier house, you don’t need to turn your nursery into a Babies ‘R’ Us, and you don’t need worthier headaches. Talk to parents who found ways to minimize expenses by stuff mindful of using only what their victual truly needed and you’ll likely find yourself far happier (and certainly less cluttered).