Whether you’re a newbie or a seasoned investor, you’ve probably heard these words from a friend or family member who invests in the S&P 500:

“Just buy an alphabetize fund.” Consider the words of the billionaire investor Warren Buffet:

“In my view, for most people, the weightier thing to do is own the S&P 500 alphabetize fund”.

Warren took it one step further, once betting hedge fund manager Ted Seides $1 million that an alphabetize fund would outperform a portfolio of hedge funds over the next ten years.

What Is the S&P 500?

S&P stands for Standard & Poors, one of the most well-known financial companies in the world over the past 150 years. The S&P 500 is an alphabetize of roughly 500 large-cap US stocks. It’s a widely used benchmark for US stock market performance. It differs from the Dow Jones alphabetize considering it includes a wider range of tech and growth stocks. The Dow Jones only consists of 30 stocks vs. 500 in the S&P.

Interestingly, plane though the S&P 500 gives a largest representation of the “stock market” performance, my financial planning clients unchangingly used the Dow Jones as their reference. I was often asked, “How’s the Dow doing today?”

Yet, when you read anything well-nigh how the market is performing or hear an expert share on CNBC what the market is doing, they usually refer to the S&P. The S&P 500 moreover serves as a lead benchmark for US probity performance. When the S&P 500 is up, other US stocks tend to follow suit.

It moreover gives investors a good gauge to compare how their portfolio or unrepealable investment are performing. For example, if you own Tesla and the S&P is down, but your stock is up, you know your investment is doing well. Thank you, Elon!

S&P 500 Industry Sectors

There are 11 sectors in the S&P 500, ranked unelevated by the percentage of the alphabetize represented by each:

- Information Technology (26.4%)

- Health Care (15.1%)

- Consumer Discretionary (11.7%)

- Financials (11.0%)

- Communication Services (8.1%)

- Industrials (7.9%)

- Consumer Staples (6.9%)

- Energy (4.5%)

- Utilities (3.1%)

- Real Estate (2.8%)

- Materials (2.5%)

What Is Required to Be Listed in S&P 500?

According to SPC Global, to be included in the S&P 500, a visitor must meet the pursuit criteria:

- It must be headquartered in the United States.

- File financial statements with the SEC (10-K reports)

- Have a market cap whilom $8.2 billion.

- Have at least 50% of its float-adjusted shares outstanding listed on a US stock exchange.

- Be considered a “blue chip” company, meaning it must have stability and continuity of earnings and dividend payments.

- Not be in bankruptcy proceedings.

- It must have a market capitalization of at least $8.2 billion.

- It must be listed on the NYSE, Nasdaq, or Cboe BZX Exchange.

- It must have posted positive earnings in the most recent four quarters.

The most recent additions include: Crocs, ServiceNow, and Zoom Video Communications.

Top 10 Companies in the S&P 500

- 1. Apple Inc. (AAPL)

- 2. Microsoft Corporation (MSFT)

- 3. Amazon.com, Inc. (AMZN)

- 4. Alphabet Inc. A (GOOGL)

- 5. Tesla, Inc. (TSLA)

- 6. Berkshire Hathaway Inc. (BRK.B)

- 7. Unitedhealth Group Inc (UNH)

- 8. Alphabet Inc. C (GOOG)

- 9. Exxon Mobil Corporation (XOM)

- 10. Johnson & Johnson (JNJ)

The companies transpiration often, but these ten have been pretty resulting over the last five years. Apple, Amazon, and Google (Alphabet) are all tech companies. These three companies make up a large portion of the S&P 500 index. In fact, as of October 2019, they make up well-nigh 22% of the unshortened index!

How to Invest in the S&P 500

There are many ways to invest in the S&P 500. You can buy individual stocks, purchase an alphabetize fund or exchange-traded fund (ETF), or create your own M1 Finance alphabetize fund (I’ll imbricate that later.)

Buy individual stocks: This is probably the most challenging way to invest in the S&P 500. Not only do you need to have a large sum of money to invest, but you moreover need to know what stocks to buy. And plane if you buy the right stocks, there’s no guarantee they will perform well.

Purchase an alphabetize fund: An index fund is a type of bilateral fund that aims to track the performance of a specific market index, such as the S&P 500. Alphabetize funds are a unconfined way to invest in the stock market considering they offer diversification and professional management.

The largest 3 bilateral funds on the S&P 500 are :

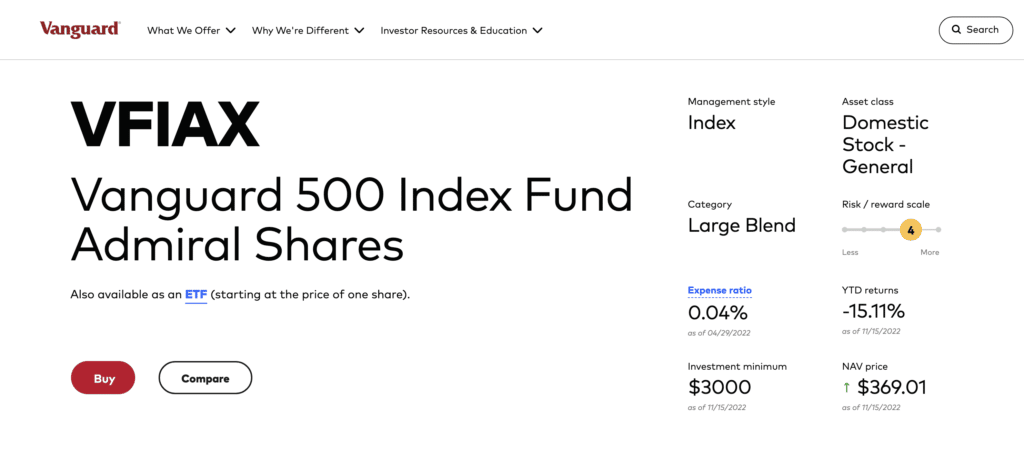

- Vanguard 500 Alphabetize Fund Admiral Shares (VFIAX)

- Vanguard Institutional Alphabetize Fund Institutional Plus Shares (VINIX)

- Schwab S&P 500 Alphabetize Fund (SWPPX)

Buy an ETF: An exchange-traded fund (ETF) is a type of investment fund that tracks the performance of a particular windfall or group of assets. Like alphabetize funds, ETFs offer diversification and professional management.

The top 3 S&P 500 ETFs are:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

If you can’t handle the ups and downs of the stock market, don’t buy the S&P 500.

Should You Invest in the S&P 500?

There’s no easy wordplay to this question. It depends on your goals, risk tolerance, and time horizon. If you’re investing long-term and can stomach a little volatility, then investing in the S&P 500 may be a good choice. However, if you’re looking for firsthand returns or can’t handle the ups and downs of the stock market, don’t buy the S&P 500.

Pros of Investing in the S&P 500:

Diversification: When you invest in the S&P 500, you’re ownership a piece of 500 variegated companies. This diversification can help protect you from losses if any one visitor underperforms. And since the alphabetize represents 11 variegated industry sectors and approximately 80% of the total capitalization of all US stock markets, you can enjoy overall diversification in the US economy.

Professional management: Alphabetize funds and ETFs are managed by professionals who know how to pick stocks and intrust assets, taking the guesswork out of investing for many people.

Low cost: Considering S&P funds are tracking the index, there is little to no zippy management required. Therefore, fund managers can alimony financing to a minimum. This is unlike urgently managed bilateral funds, whose managers are trying to write-up the benchmark.

The S&P 500 outperforms urgently managed funds: The Index beats nearly 80% of urgently managed funds.

S&P 500 alphabetize funds pay dividends: Since the alphabetize represents the largest corporations in America, many are well-established companies that pay dividends regularly. Those dividends are paid to investors through the fund. For example, the Schwab S&P 500 Alphabetize Fund has a dividend yield of 1.54%.

Performance: The S&P 500 has an stereotype yearly return of 9.4% between 1972 and 2021. And, as it turns out, it turns positive returns in the vast majority of years!

Cons of Investing in the S&P 500:

Volatility: The stock market can be volatile, which ways that the value of your investment can go up and down. If you’re investing for the short term, this volatility can be a big risk.

No guaranteed returns: There’s no guarantee that you will make money by investing in the S&P 500, and you could lose money.

No international diversification: The S&P 500 is invested entirely in companies that trade on US stock exchanges, and there is no foreign exposure to established or emerging markets.

Large-cap stocks only: The alphabetize comprises the US’s 500 largest publicly traded companies. It provides no diversification into mid-and small-cap stocks.

The S&P 500 doesn’t unchangingly lead the market: Though it has outperformed other indices in recent years, that isn’t unchangingly the case. Other investment strategies, like value investing and small-cap stocks, have performed largest in variegated market environments.

Market capitalization weighting: Though the S&P 500 represents the 500 largest publicly traded corporations in America, the alphabetize itself is calculated by the market weight of each component company. The companies with the largest market capitalization make up a untempered percentage of the alphabetize value.

For example, as of April 2022, the ten largest holdings in the alphabetize represented nearly 30% of its total value. A severe ripen in the stock price of any of just three or four of those top holdings could have an outsized negative effect on the index’s overall performance.

Create Your Alphabetize Fund in M1 Finance

With M1 Fiance, you can hands create your own alphabetize fund and invest in the S&P 500 with no management fees or commissions. Plus, you can reinvest your dividends and grow your investment over time.

To get started, sign up for a self-ruling worth and then follow these steps:

1. Segregate the S&P 500 from the list of indexes.

2. Select the stocks that you want to include in your fund. You can segregate the stocks manually or have M1 Finance select them based on your goals and risk tolerance.

3. Set up a recurring investment plan to regularly invest in your fund.